Summary

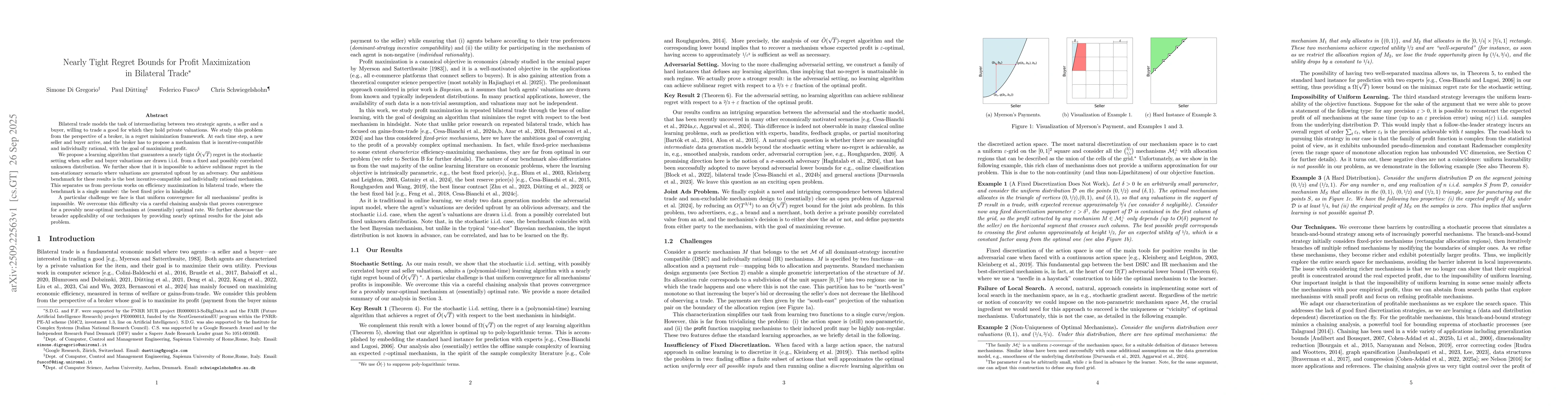

Bilateral trade models the task of intermediating between two strategic agents, a seller and a buyer, willing to trade a good for which they hold private valuations. We study this problem from the perspective of a broker, in a regret minimization framework. At each time step, a new seller and buyer arrive, and the broker has to propose a mechanism that is incentive-compatible and individually rational, with the goal of maximizing profit. We propose a learning algorithm that guarantees a nearly tight $\tilde{O}(\sqrt{T})$ regret in the stochastic setting when seller and buyer valuations are drawn i.i.d. from a fixed and possibly correlated unknown distribution. We further show that it is impossible to achieve sublinear regret in the non-stationary scenario where valuations are generated upfront by an adversary. Our ambitious benchmark for these results is the best incentive-compatible and individually rational mechanism. This separates us from previous works on efficiency maximization in bilateral trade, where the benchmark is a single number: the best fixed price in hindsight. A particular challenge we face is that uniform convergence for all mechanisms' profits is impossible. We overcome this difficulty via a careful chaining analysis that proves convergence for a provably near-optimal mechanism at (essentially) optimal rate. We further showcase the broader applicability of our techniques by providing nearly optimal results for the joint ads problem.

AI Key Findings

Generated Oct 01, 2025

Methodology

The research employs a combination of theoretical analysis and empirical evaluation to study the regret minimization in mechanism design for bilateral trade. It utilizes a chaining analysis approach to derive upper bounds on regret and establishes lower bounds through adversarial and stochastic settings.

Key Results

- An upper bound of O(\sqrt{T}) on the regret for the bilateral trade problem in the i.i.d. stochastic setting.

- A lower bound of \Omega(\sqrt{T}) for the regret in the stochastic setting, showing the result is tight.

- A lower bound of \Omega(T^{3/2 - \epsilon}) for the regret in the adversarial setting for any constant \epsilon \in (0, 1].

Significance

This research provides a comprehensive understanding of regret minimization in mechanism design, offering both theoretical guarantees and practical implications for designing efficient auction mechanisms in dynamic environments.

Technical Contribution

The paper introduces a chaining analysis technique to derive regret bounds for mechanism design problems, combining it with adversarial and stochastic analysis to establish tight upper and lower bounds on regret.

Novelty

This work is novel in its combination of chaining analysis with adversarial and stochastic settings to provide a unified framework for understanding regret minimization in mechanism design, offering both tight upper and lower bounds.

Limitations

- The analysis assumes i.i.d. stochastic settings and may not directly apply to more complex or structured environments.

- The adversarial lower bound assumes a specific adversarial sequence construction that may not cover all possible adversarial strategies.

Future Work

- Exploring extensions to more complex auction environments with multiple agents or goods.

- Investigating the application of these results to other mechanism design problems like multi-dimensional auctions.

- Developing algorithms that can handle non-i.i.d. or adversarial settings with better regret guarantees.

Paper Details

PDF Preview

Similar Papers

Found 5 papersTight Regret Bounds for Fixed-Price Bilateral Trade

Pinyan Lu, Chihao Zhang, Yaonan Jin et al.

A Regret Analysis of Bilateral Trade

Federico Fusco, Stefano Leonardi, Tommaso Cesari et al.

An $\alpha$-regret analysis of Adversarial Bilateral Trade

Federico Fusco, Yossi Azar, Amos Fiat

Better Regret Rates in Bilateral Trade via Sublinear Budget Violation

Matteo Castiglioni, Alberto Marchesi, Anna Lunghi

Comments (0)